How to waive your mortgage contingency

Here in the Boston Metro area, we remain in what can only be described as a seller’s market, with fierce bidding wars common. In order to gain an edge and make their offers more attractive to the sellers, buyers are increasingly making offers without mortgage contingencies.

If included, the mortgage contingency gives buyers the option to back out of the deal and get their deposits back if they are unable to obtain a mortgage commitment by a certain date, usually 4-6 weeks from offer acceptance. (Please note, I’m writing about Massachusetts. The process & timeline differ by market.) It’s better for the seller, of course, when this contingency is not included, because it means that if the buyer has to back out, then at least the seller gets compensation for having taken the home off the market.

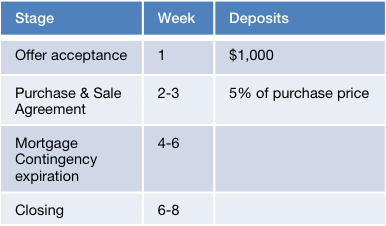

Leaving out the contingency puts a significant chunk of change at risk for the buyer. By the Purchase & Sale Agreement (approximately 14 days after offer acceptance), the buyer has typically made deposits totaling 5% of the purchase price. On a $1,000,000 purchase, that’s $50,000 that the buyers would surrender if they get declined and don’t have the contingency.

Example timeline, with a mortgage contingency:

So how can buyers remove the mortgage contingency but mitigate their additional risk?

One tactic is to work with a lender that can fully underwrite the deal within two weeks (prior to the Purchase & Sale Agreement), subject only to an appraisal which will come later. By fully underwriting the deal, the lender is able to eliminate the uncertainty over whether the buyer will qualify for the loan. Because buyers make a relatively small deposit ($1,000) at offer acceptance, and don’t make the 5% deposit until the Purchase & Sale Agreement, this gives the buyer two weeks to get approved or rejected. (Think of it as an option that costs $1,000).

At that point, the remaining uncertainty will be whether, in the bank’s estimation, the property is worth the purchase price, which will be determined by an appraisal carried out for the bank sometime after the Purchase & Sale Agreement. Therefore, we would still want to include in the offer an appraisal contingency, i.e. that it is subject to the property appraising at or above the purchase price. From the seller’s perspective, the appraisal contingency is substantially less risky than an entire mortgage contingency, since there is only one thing that can go wrong. (Of course, if someone can make a cash offer without any financing contingencies, then that is even better).

A remaining risk for the buyers, however unlikely, is that if the buyers lose their sources of income in the 4-6 weeks between the P&S and the closing, then the lender is likely to withdraw their commitment. Even with the mortgage contingency included, you would still have this risk in the 1-2 weeks between the contingency expiring and the closing. In this case, you’ll be at the mercy of the seller.

If you are going to consider doing this, an important consideration is the strength of your pre-approval letter. According to Phil Ganz, a loan officer at Fairway Mortgage, “not all pre-approvals are created equal. For example, in a Fairway Mortgage pre-approval, we verify the income and asset documentation upfront, so that an expedited approval is possible.” In other words, getting as much done before even making an offer will put you in a better position to make an offer without a mortgage contingency if need be.

Please let me know if you’d like to discuss this tactic or anything else to do with home buying and selling.

Questions? Email me and let's set up a time to discuss your real estate needs.

AVI KAUFMAN is a top broker who lives in Brookline, Massachusetts and works there and surrounding communities, assisting buyers and sellers of residential property. He is building a unique practice dedicated to serving the best interest of his clients - see how he's different.